Project Snapshot

Strategic Investment

GoldMining Inc. owns approximately 81% of U.S. GoldMining Inc. ("U.S. GoldMining") which is focused on unlocking the substantial value of the Whistler gold-copper project, located in Alaska, USA. U.S. GoldMining completed an IPO in April 2023, listing on Nasdaq (NASDAQ:USGO) and raising US$20 Million to be used for exploration and mining studies of the Whistler project.

U.S. GoldMining is managed by an experienced team and a Board of Directors who are motivated to unlock value by advancing the extensive and exciting Whistler gold-copper project.

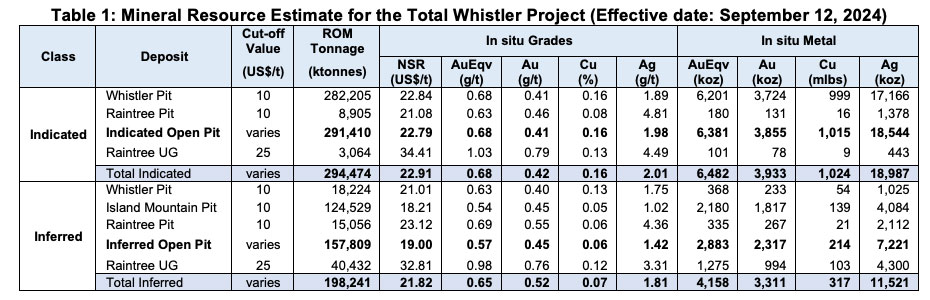

Whistler is a large gold-copper porphyry exploration project located 105 miles (170 km) northwest of Anchorage, Alaska, USA, covering a comprehensive regional land package totalling 53,700 acres (217 sq km). Mineral resources have been estimated at three gold-copper porphyry deposits (Whistler, Raintree West and Island Mountain) containing a total indicated resource of 6.5 million gold equivalent ounces and a total inferred resource of 4.2 million gold equivalent ounces - Resource Statement.

Project overview

Whistler is a resource stage gold-rich copper porphyry exploration project located within the Alaska Range, 105 miles (170 km) northwest of Anchorage, Alaska, USA. The regional land package comprises State of Alaska mining claims totaling 53,700 acres (217 sq km).

The Whistler Project has indicated resources of 3.0 million gold equivalent ounces and inferred resources of 6.5 million gold equivalent ounces (see Resources). Mineral resources have been estimated at three gold-copper porphyry deposits (Whistler, Raintree West and Island Mountain) to date, and the property contains numerous additional geophysical and geochemical targets some of which have historic mineralized drill intercepts that require follow-up drilling.

The Whistler Gold-Copper Project is supported by a basecamp and gravel airstrip which can support year-round field exploration programs.

Whistler’s growth potential includes opportunities for U.S. GoldMining’s technical team to apply new regional geologic models and geophysical modelling methods to unlock value at Whistler. In addition, the Company is following best practices in safety, environment, and sustainability to optimize project advancement towards eventual future potential mine permitting and development.

Location

105 miles northwest of Alaska, USA

Property

Size 53,700 acres (217 sq km)

Ownership

100%

Commodity

Gold, Copper, Silver

Infrastructure

Airstrip and 24 person camp. Drill access trails connect the camp with the Whistler and Raintree deposits. A seasonal winter road route has been established and used historically by other companies operating in the district.

Deposit Type

Gold-rich copper porphyry

Location

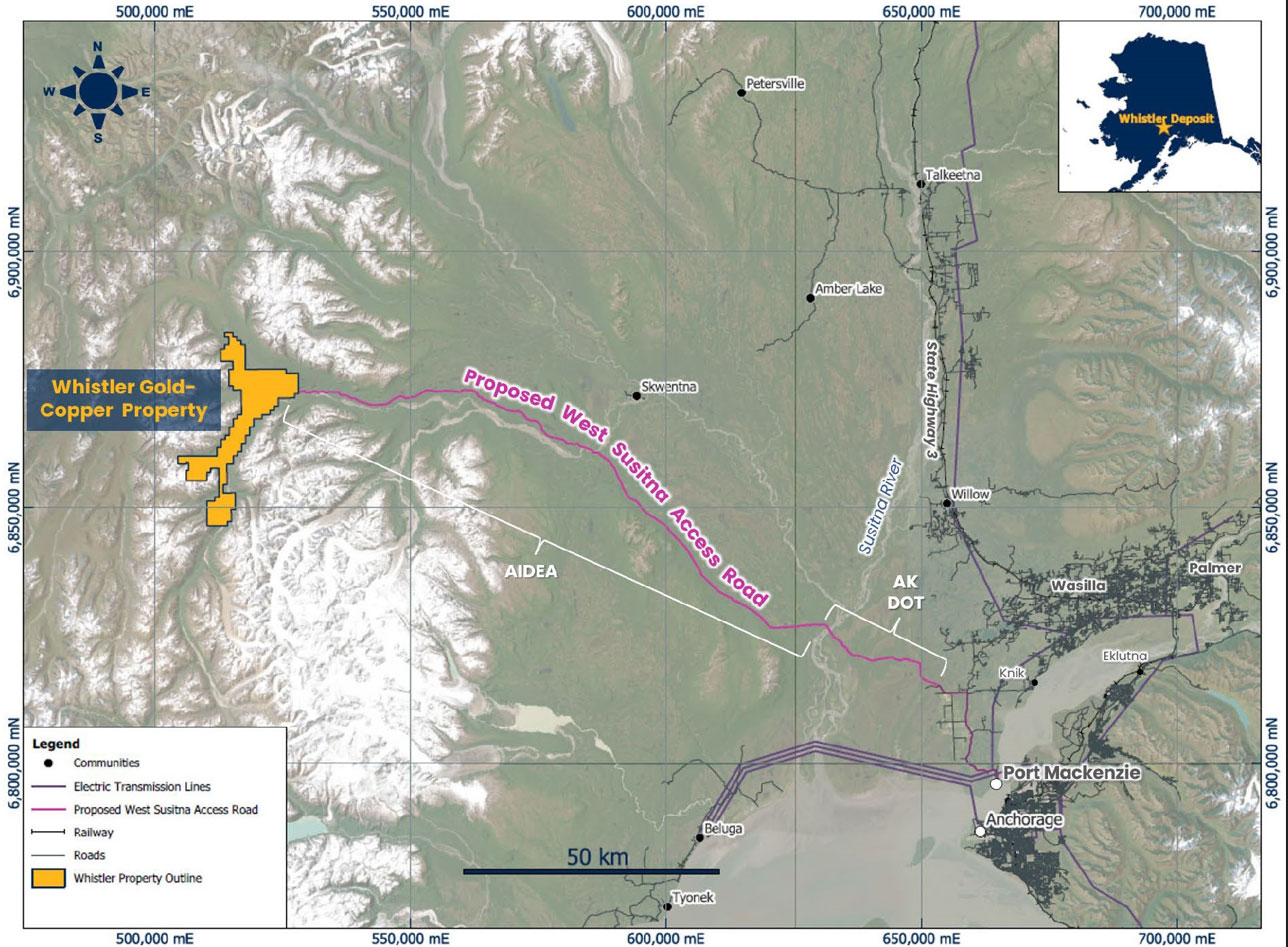

The Whistler Project is located in the Alaska Range approximately 150 miles (170km) northwest of Anchorage. The centre of the property is located at 152.57 degrees longitude west and 61.98 degrees latitude north.

The Whistler property comprises 304 State of Alaska mining claims covering an aggregate area of approximately 53,700 acres (217km2) in the Yentna Mining District of Alaska. The claims are owned 100% by U.S. GoldMining.

An all-season camp facility exists near the confluence of Portage Creek and the Skwentna River, and adjacent to the Whisky Bravo 1,000-meter-long gravel airstrip.

West Susitna Access Road

Exploration and mining in the Alaska Range is receiving strong local support at the community, regulator, and state political level. The Alaska State Government has initiated a ‘Roads to Resources’ program to design, permit and build the West Susitna Road which will link the Whistler Project with road, rail, power, and port infrastructure in south central Alaska.

From Anchorage, Whistler is located 105 miles northwest across the Yentna – Susitna River Valley, a broad alluvial plain. A road to access this area is a relatively simple matter in terms of engineering and with the State leading this work, ultimately the Company expects an efficient permitting process and a shared capital cost of the road construction with the State and other potential proponents operating in the district.

AIDEA’s brief is to study, optimize and build infrastructure projects that will deliver growth to the Alaskan economy. AIDEA (Alaska Industrial Development & Export Authority) has completed three major studies on the West Susitna Access Road since 2014, to assess route alternatives, cost and benefits, environmental and cultural impacts, and the benefits to the Alaskan economy of building a road that will provide access to various natural resources and also open up recreational access to the public.

In 2021, $8.5M was budgeted for AIDEA to undertake preliminary design, environmental baseline, and stakeholder consultation. On July 27, 2023, the Alaska Department of Transportation and Public Facilities (“DOT&PF”) announced plans to include the first 15 miles of the WSAR, including a major bridge over the Susitna River, within its draft ‘2024-2027 Statewide Transportation Improvement Program’, with funding set aside for construction to begin in 2025, pending permitting. Subsequent to the DOT&PF announcement, on July 28, 2023, AIDEA announced that it will continue working on a separate and additional portion of the WSAR, extending beyond the proposed DOT&PF road build to establish an industrial access corridor to several exploration and development projects in the West Susitna Mining District, including the Company’s Whistler project.

A key advantage which the West Susitna Road will provide to the Whistler Project, is the already constructed but underutilized port facility at Port Mackenzie which lies at the eastern terminus of the proposed road.

Via press release on March 21, 2023, Governor Mike Dunleavy said, “The West Susitna Road is important for local residents and gaining fair access to hunting, fishing, and potential jobs. My Administration is constantly looking at ways to grow our economy and this project is a great opportunity for not only south-central Alaska but the entire state. I am committed to this project and unlocking resources that benefit all Alaskans.”

Geology and Mineralization

Alaska consists of a collage of various geologic terranes that were accreted to the western margin of North America as a result of complex plate tectonics throughout the Phanerozoic (from 540 million years ago to present day).

The Alaska Range represents a long-lived continental volcanic arc characterized by multiple magmatic events ranging in age from about 76 million years ago ("Ma") to present day, and hosts a wide range of base and precious metal mineralization.

The geology of the Whistler Project is characterized by a thick succession of Jurassic to Cretaceous sedimentary rocks, upon which late Cretaceous through to early Tertiary (ca. 76 to 64 Ma) volcanic rocks were deposited. These rocks are in turn intruded by a diverse suite of plutonic rocks of late Cretaceous to mid-Tertiary age.

Two main intrusive suites are important in the Whistler Project area:

- The Whistler Igneous Suite comprises alkali-calcic basalt-andesite, diorite and monzonite porphyry intrusive rocks dated to approximately 76Ma, with minor extrusive correlative volcanic equivalent rocks. The porphyry intrusions are commonly associated with gold-copper porphyry-style mineralization (e.g. Whistler Deposit).

- The Composite Suite intrusions vary in composition from peridotite to granite and their ages span from 67 to about 64Ma. Gold-copper veinlets and pegmatitic occurrences are characteristics of the Composite plutons (e.g. Estelle deposit (Nova Minerals) and the Muddy Creek prospect).

Early exploration work completed by Cominco, Kennecott, Geoinformatics and Kiska has discovered several gold-copper porphyry -style sulphide occurrences. The Whistler property contains numerous geophysical and geochemical anomalies suggesting that the project area is highly prospective for magmatic hydrothermal mineralization including potential for additional porphyry gold-copper deposits.

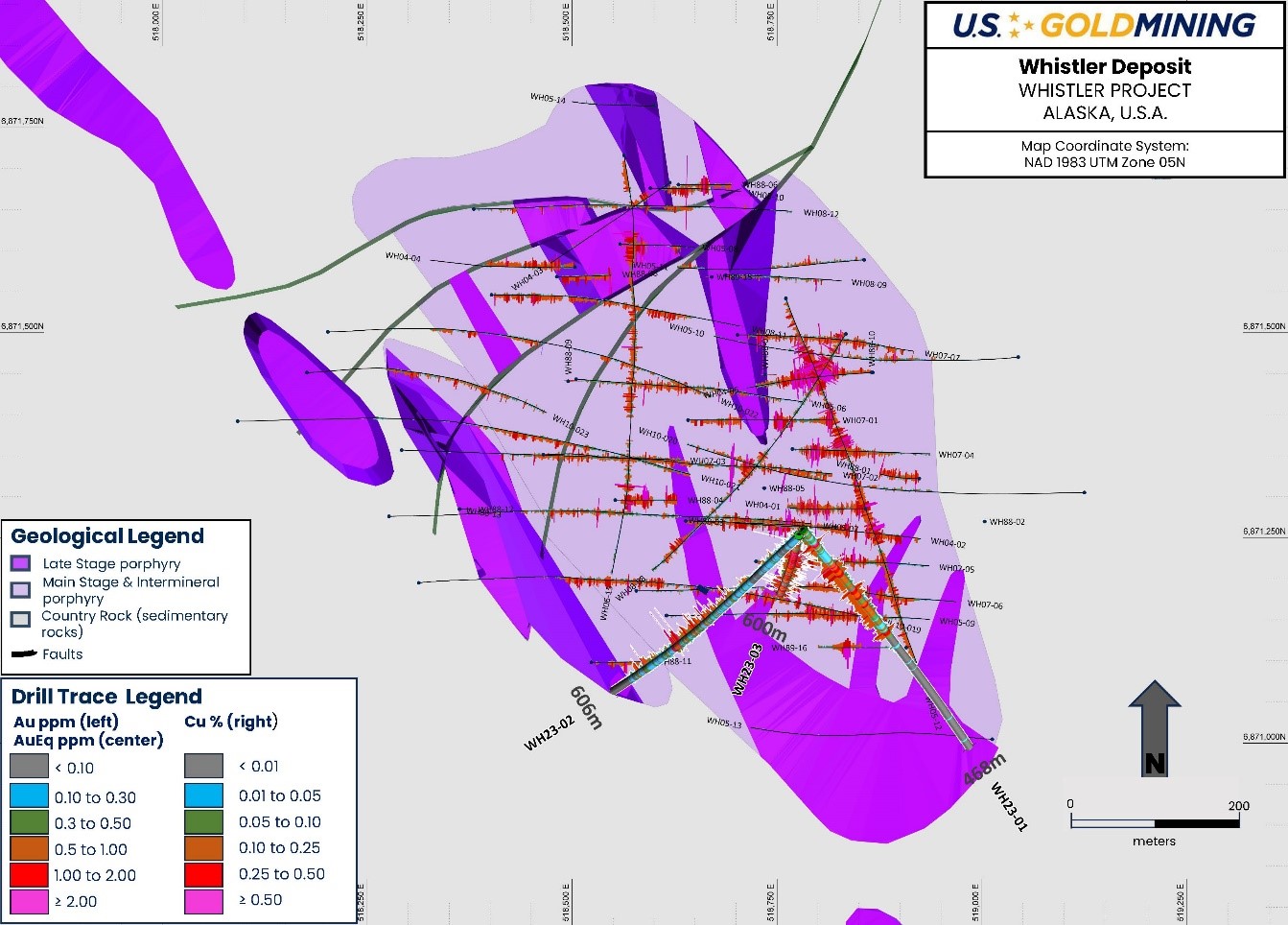

2023 Program Summary

Four drill holes were completed for a total of 2,234 meters at the Project from mid-August to mid-November, 20524. Highlight intercepts are as follows:

- WH23-03 intersected 599.74 meters at 0.99 g/t AuEq from surface (0.41 meters depth) and included 547.15 meters at 1.06 g/t AuEq, comprised of 0.77 g/t gold (Au), 0.17% copper (Cu) and 1.55 g/t silver (Ag), from 53.00 meters depth to end of hole at 600.15 meters.

- Including a higher-grade intercept of 176.00 meters at 1.55 g/t AuEq from 131.00 meters depth.

- WH23-03 infilled an area of previously sparse drilling, with corresponding lower confidence resource classification, on the southern margin of the Deposit’s ‘high-grade core’. Assay results confirm the continuity of mineralization extending from near surface throughout the length of the drill hole. The lower half of WH23-03 infilled an area of the Deposit currently classified as inferred in the Whistler mineral resource estimate, which may be upgraded in future iterations of the resource model.

- Mineralization intersected in WH23-03 remains open at depth, including a high-grade interval of 25.15 meters at 1.12 g/t from 575.00 meters to end of hole.

- The Company intends to deepen the hole to explore the depth extents of the Whistler mineral system in 2024.

- WH23-01 intersected 241.05 meters at 0.60 g/t AuEq, comprised of 0.33 g/t Au, 0.16% Cu and 1.86 g/t Ag, from surface (1.95 meters depth).

- Including an upper high-grade intercept of 8.00 meters at 1.26 g/t AuEq from 29.00 meters depth.

- An intercept of 118.00 meters at 0.74 g/t AuEq from 77.00 meters, which includes several higher-grade zones:

- 31.0 meters at 1.00 g/t AuEq from 77.00 meters

- 19.23 meters at 1.06 g/t AuEq from 137.77 meters

- 8.00 meters at 1.16 g/t AuEq from 231.00 meters

- WH23-01 confirmed that mineralization extends to surface on the south side of the Whistler Ridge, a steep slope that presents challenges for building drill platforms and which was subsequently under-drilled in the past.

- WH23-02 intersected 142.34 meters at 0.51 g/t AuEq, comprised of 0.17 g/t Au, 0.21% Cu and 1.05 g/t Ag, from 305.00 meters depth.

- Including a higher-grade zone of 22.00 meters at 1.10 g/t AuEq from 401.00 meters depth.

- WH23-02 successfully expanded the Whistler Deposit approximately 100 meters to the south of previously drilled mineralization in the southwest sector of the Deposit. Mineralization remains open to surface, to depth and south along strike. Follow-up drilling in 2024 will aim to extend the resource to surface and test for additional expansion southwards and to depth.

- WH23-04 tested the Rainmaker South target, a target external to existing mineral resources and located approximately one kilometer southeast of the Whistler Deposit. Core logging indicates the drill hole intersected a porphyry intrusive stock, confirming and validating the geophysical modeling used to target potential new porphyry stocks. Assays are currently pending; however, visual core logging indicates a lack of veining and alteration which are normally indicative of a productive porphyry intrusion.

Resource Statement

GoldMining Inc. Equity Interest: 81%

Notes to Table 1:

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves.

- Inferred mineral resources are subject to uncertainty as to their existence and as to their economic and legal feasibility. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability.

- The Mineral Resource Estimate for the Whistler, Island Mountain, and the upper portions of the Raintree West deposits have been confined by an open pit with “reasonable prospects of economic extraction” using the following assumptions:

- Metal prices of US$1,850/oz Au, US$4.00/lb Cu and US$23/oz Ag;

- Payable metal of 95% payable for Au and Ag, and 96.5% payable for Cu

- Refining costs for Au of US$8.00/oz, for Ag of US$0.60/oz and for Cu of US$0.05/lb.

- Offsite costs for Au of US$77.50/wmt, for Ag of US$3.50/wmt and for Cu of US$55.00/wmt.

- Royalty of 3% NSR;

- Pit slopes are 50 degrees;

- Mining cost of US$2.25/t for waste and mineralized material; and

- Processing, general and administrative costs of US$7.90/t.

- The lower portion of the Raintree West deposit has been constrained by a mineable shape with “reasonable prospects of eventual economic extraction” using a US$25.00/t cut-off.

- Metallurgical recoveries are: 70% for Au, 83% for Cu, and 65% Ag for Ag grades below 10g/t. The Ag recovery is 0% for values above 10g/t for all deposits.

- The NSR equations are: below 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$54.646/t) + (Cu*83%*US$3.702*2204.62 + Ag*65%*US$0.664)), and above 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$56.646g/t) + (Cu*83%*US$3.702*2204.62))

- The Au Equivalent equations are: below 10g/t Ag: AuEq=Au + Cu*1.771 +0.0113Ag, and above 10g/t Ag: AuEq=Au + Cu*1.771

- The specific gravity for each deposit and domain ranges from 2.76 to 2.91 for Island Mountain, 2.60 to 2.72 for Whistler with an average value of 2.80 for Raintree West.

- The SEC definitions for Mineral Resources in S-K 1300 were used for Mineral Resource classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions).

- Numbers may not add due to rounding.

Additional details of the mineral resource estimate are set forth in the S-K 1300 Report titled “S-K 1300 Technical Report Summary Initial Assessment for the Whistler Project”, Effective Date 12 September 2024 and Date of Issue 7 October 2024, a copy of which is available under the Company's profile at www.sec.gov.